How to Add Multiple Account in Sbi Online Banking

State Bank of India (SBI), the largest public sector bank in India, offers a net banking facility to its customers, both retail customers as well as corporate customers. In a recent move, State Bank of India leads five other public sector banks such as State Bank of Mysore, State Bank of Hyderabad, State Bank of Patiala, State Bank of Travancore, and State Bank of Bikaner and Jaipur. Here is a detailed breakdown of the different aspects of SBI net banking.

![]()

Pro Tip: Invest in direct funds pay 0% commission and earn upto 1.5% extra returns Invest Now

State Bank of India (SBI)

| Owner | Government of India |

| Chairperson | Dinesh Kumar Khara |

| Headquarters | Mumbai |

| Customer service | 1800 425 3800 |

| Founded | 1st July 1955 |

How to register for SBI net banking?

TO register for SBI Netbanking Individual account holders must satisfy the following criteria to be able to register for net banking services online.

- You must have a savings account with SBI.

- You must have linked your mobile number with the bank account.

- You must have a valid ATM card.

- To register online, you should not apply for the facility at the branch.

Follow the below steps to register for the net banking facility with SBI online.

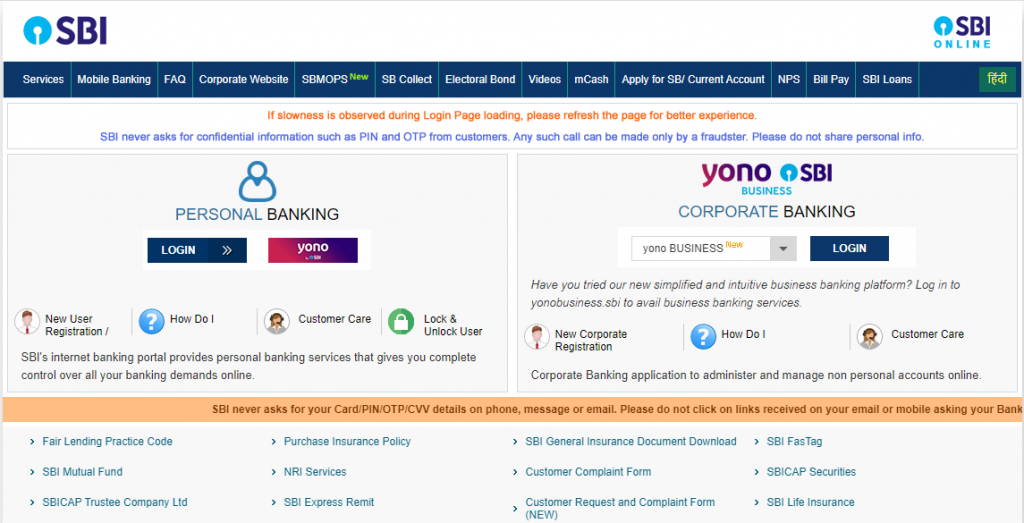

Step 1: Visit the official internet banking website at https://www.onlinesbi.com/.

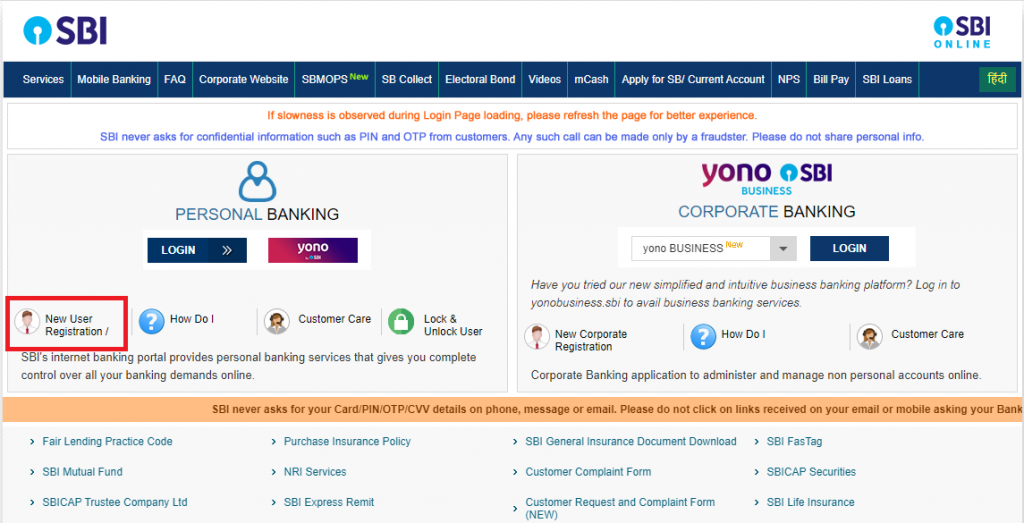

Step 2: Click on 'New User Registration/Activation'

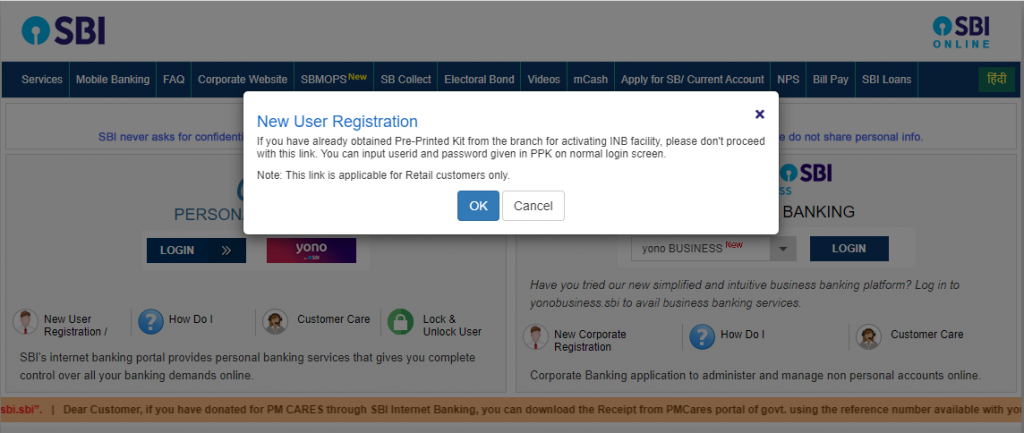

Step 3: A pop-up window will appear on the screen to confirm that you have not received an internet banking kit. Click on 'OK'.

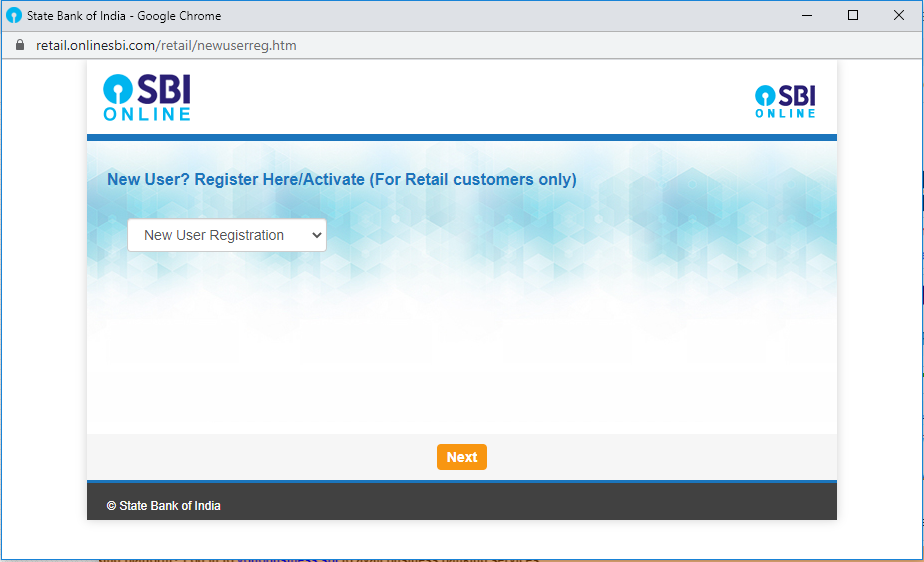

Step 4: Select the 'New User Registration' option from the drop-down menu and click 'Next'.

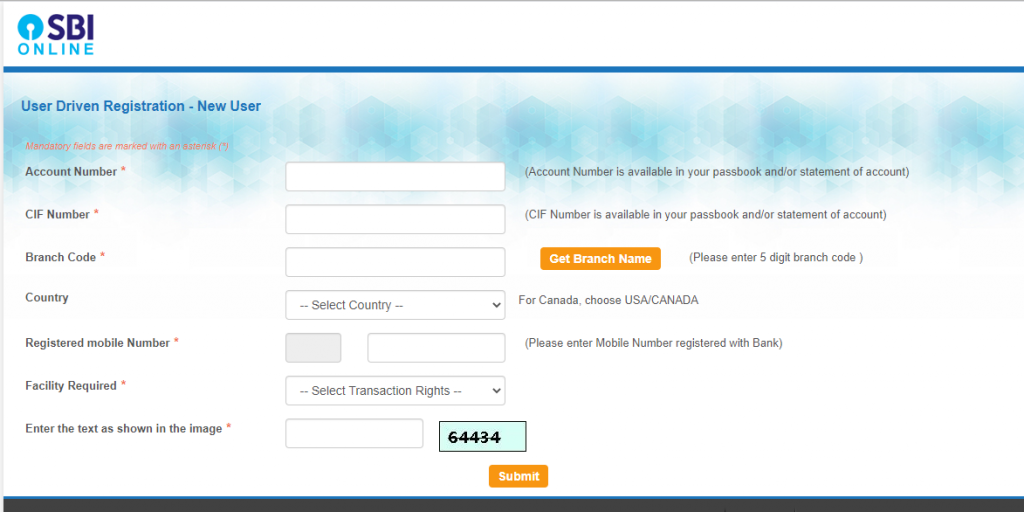

Step 5: In the next screen that appears, fill up the details such as the account number, CIF number, branch code, country, registered mobile number, and the facility you want to sign-up for. Also, enter the captcha code correctly. If you are unable to figure out the branch code, you can find it under the 'Get Branch Code' option. You must enter the state and the branch name to get the branch code.

Step 6: Under the 'Facility Required' field, you can select one of the following options: View, limited transactions, and full transactions.

Step 7: Click on the 'Submit' button.

Step 8: An OTP will be sent to the registered mobile number. Enter the OTP on the screen and click 'Confirm'.

Step 9: Select the option 'I have my ATM card' and click 'Submit'.

Step 10: Now, enter the ATM card details on the screen and click 'Submit'.

Step 11: A temporary username will be displayed on the screen; take note of this username.

Step 12: Set a password that adheres to all the rules such that you can remember it. Click 'Submit' to complete the registration process.

How to login to State Bank of India net banking?

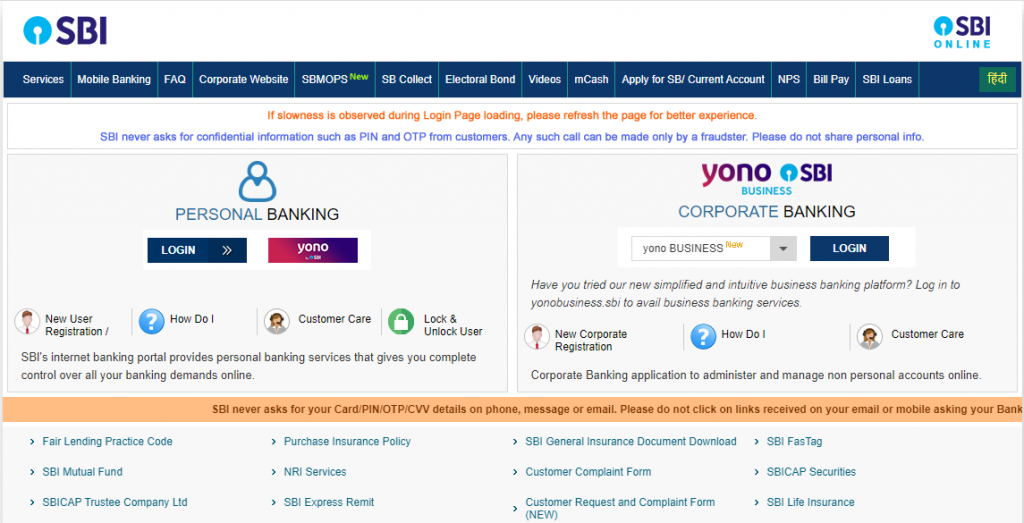

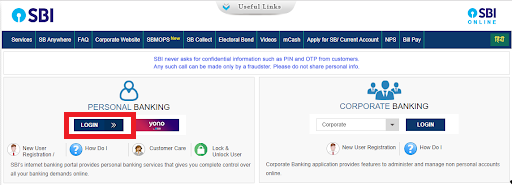

Step 1: Visit the official website https://www.onlinesbi.com/ to see the login page for both personal banking as well as corporate banking.

Step 2: Click on the 'Log In' button on the personal banking section.

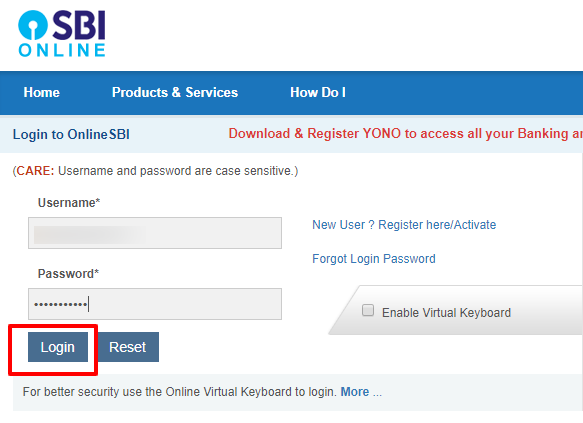

Step 3: Enter your username and password details on the screen and click 'Login' to access your account.

Step 4: You will be redirected to a page where you can access all information related to your account.

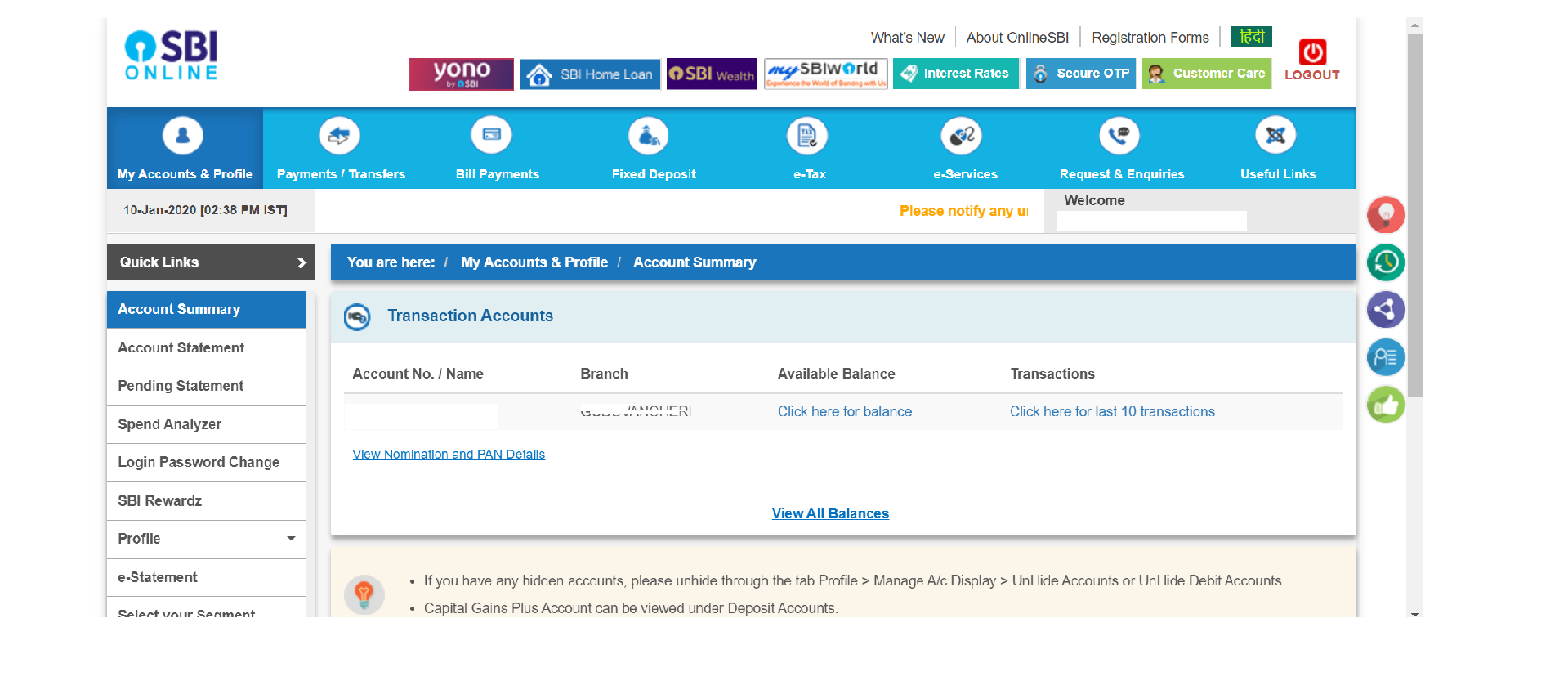

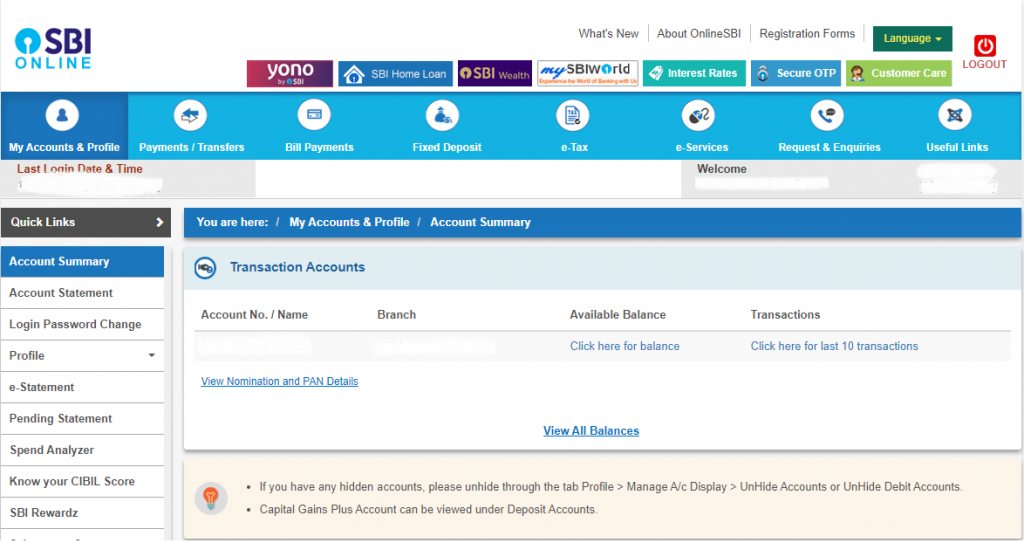

How to check account balance in SBI net banking?

Once you log into your SBI net banking account, you can click on the 'Account Summary' option available under the 'Quick Links'. You will see a list of all the accounts you hold with the bank. Click on the 'Click here for balance' option against the account to know the balance.

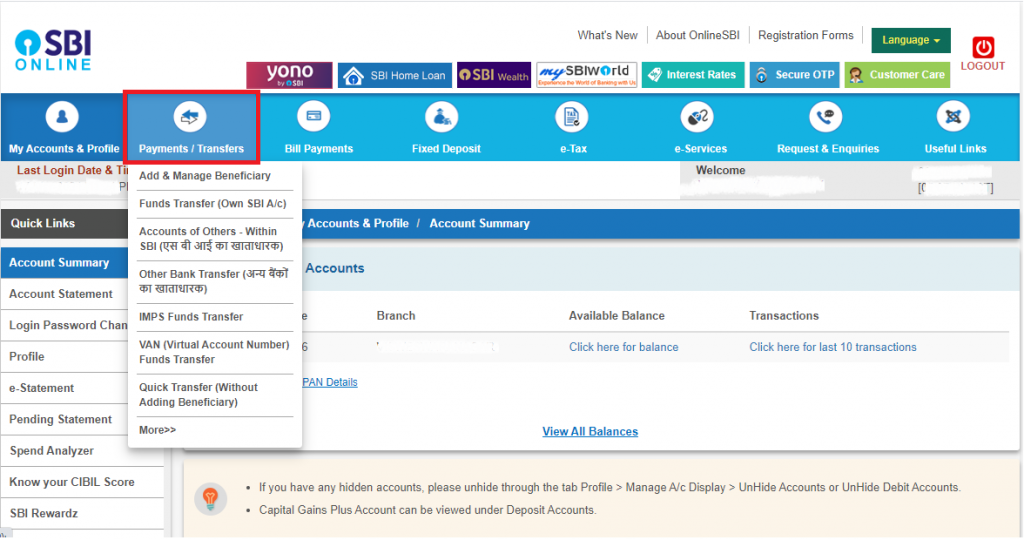

Steps to transfer money via SBI net banking portal

Before transferring money online, you have to make sure that the recipient is added as a beneficiary to your account. You require the details, such as beneficiary name, account number, bank name, and IFSC. Follow the steps below to initiate a money transfer:

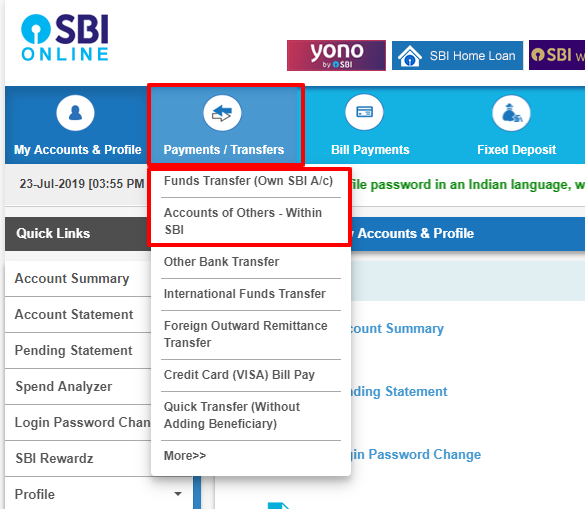

Step 1: Log in to the OnlineSBI portal.

Step 2: Click on 'Other Bank Transfer' under the 'Payments/Transfer' tab if you wish to transfer money to another bank's account.

Step 3: If you wish to transfer to an account within the same bank, click 'Accounts of Others – Within SBI'.

Step 4: A screen will appear according to your selection, choose the type of transaction you would like to make and click 'Proceed'.

Step 5: From the list, choose the account you wish to make the fund transfer from.

Step 6: Now, enter the amount you wish to transfer and remarks if any.

Step 7: Choose the beneficiary account to transfer the funds.

Step 8: You can also instruct when the fund transfer must take place using the option available.

Step 9: Agree to the terms and conditions by selecting the checkbox and click 'Submit'.

Step 10: The following screen will show all the details you entered for review. Once you are sure that all the details are correct, click 'Confirm'.

Step 11: You will receive a high-security password on the registered mobile number. Enter this password and click 'Confirm' to complete the authentication process.

Step 12: A confirmation message will be displayed on the screen to mark the completion.

Invest in Direct Mutual Funds

Save taxes upto Rs 46,800, 0% commission

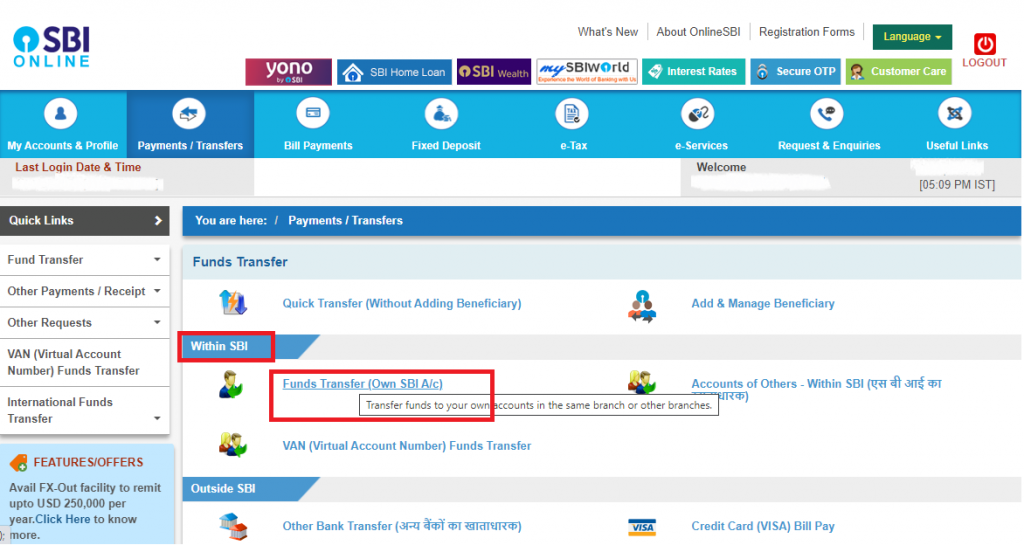

Steps to transfer money from savings account to home loan account

It is recommended that you stick to ECS and NACH facilities rather than transferring money from your savings account to your home loan account manually on a monthly basis. When you make a manual money transfer, the bank may misunderstand that you are making a prepayment towards the loan. Therefore, you need to keep the bank informed before making such a manual transfer only if there is an error in the automated EMI payment system.

In order to make a money transfer from your savings account to the home loan account, you need to be registered for the SBI Net Banking service.

Step 1: Log in to the SBI Net Banking portal using your credentials.

Step 2: Click on the 'Payments/Transfers' tab on the top of the home page.

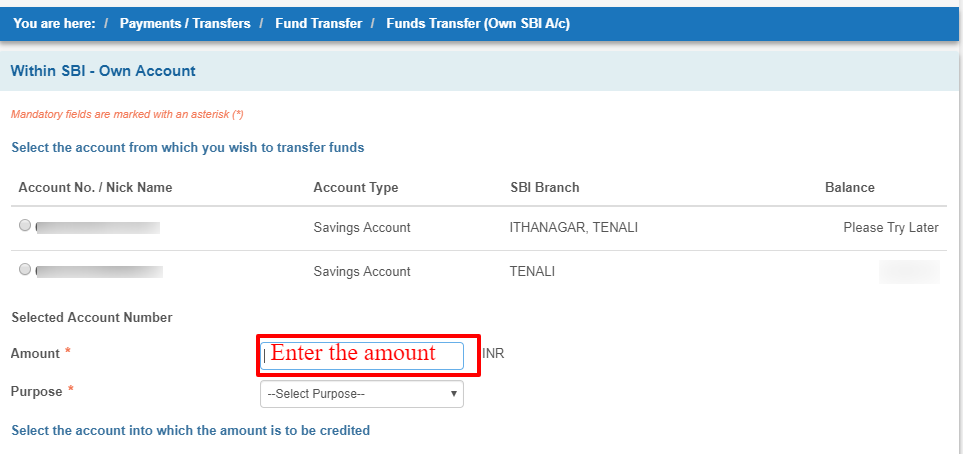

Step 3: A new screen will appear. Click on the 'Funds Transfer (Own SBI A/c)' option under the 'Within SBI' section.

Step 4: A list of your SBI accounts will be displayed. Select the home loan account number from the list.

Step 5: Enter the loan amount you would like to transfer and select the purpose of the transfer from the drop-down menu.

Step 6: Select the payment option as to when you would like to make the transfer, i.e. whether you want to pay instantly or schedule for a later time.

Step 7: Click on the 'Submit' button.

Step 8: All the details you have entered will be displayed on the screen. Verify the details and click 'Confirm' if everything looks correct.

Step 9: A success message will appear. The money will be debited from your savings account and be credited to your loan account.

Transaction limits and charges applicable

| Transaction Type | Per Day Limit | Overall Daily Limit | EasyPIN Overall Category Limit | EasyPIN Individual Overall Daily Limit | Charges |

|---|---|---|---|---|---|

| IMPS | Per Transaction Limit: Rs.2,00,000 | Rs.2,00,000 | Rs.1,00,000 | Rs.1,00,000 | Nil |

| Quick Transfer | Per Transaction Limit: Rs.10,000; Per Day Limit: Rs.25,000; Overall Daily Limit: Rs.2,00,000 | Rs.10,00,000 | Per Transaction Limit: Rs.10,000; Per Day Limit: Rs.25,000 | Nil | |

| NEFT | Rs.10,00,000 | No limit | Rs.1,00,000 | Up to Rs.50,000: Nil Rs.50,000-Rs.1 lakh in excess of Rs.50,000: Rs.0.20 per Rs.1,000 for the excess amount Rs.1 lakh-Rs.1,29,000: Rs.10 + Rs.0.50 per Rs.1,000 in excess of Rs.1 lakh Rs.1,29,000 and above: Rs.25 per transaction irrespective of the transfer amount | |

| RTGS | Rs.10,00,000 | No limit | N/A | Rs.25 per transaction for transactions of any amount | |

| UPI | Rs.1,00,000 | Rs.1,00,000 | Rs.1,00,000 | Nil | |

| Transfer Within Self Accounts | Rs.2,00,000 | Rs.2,00,000 | Rs.1,00,000 | Nil | |

| Transaction Limit for a New Beneficiary (First 4 Days) | Rs.1,00,000 | Rs.1,00,000 | Rs.1,00,000 | Nil | |

| Third-Party Transfer within SBI | Rs.10,00,000 | Rs.10,00,000 | Rs.1,00,000 | Nil |

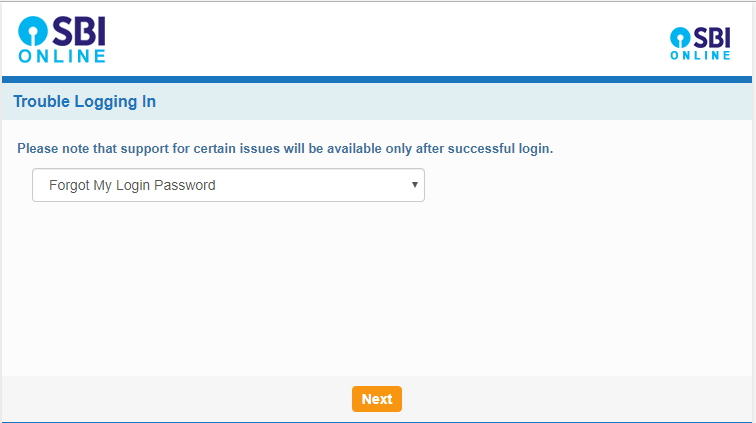

How to reset the password in SBI net banking login ?

Step 1: Visit the official website https://www.onlinesbi.com/.

Step 2: Click 'Login' under 'Personal Banking' section.

Step 3: Click on the 'Continue to Login' button.

Step 4: In the login screen, click 'Forgot Login Password'.

Step 5: A pop-up window will appear with a dropdown menu. Select the 'Forgot My Login Password' option and click 'Next'.

Step 6: In the following screen, provide details such as username, account number, date of birth, mobile number, country, and captcha code.

Step 7: Click 'Submit' when you are done entering the details.

Step 8: An OTP will be sent to your registered mobile number. Enter this OTP on the screen and click 'Submit'.

Step 9: You will be redirected to a page where you can reset the password.

Frequently Asked Questions

What should I do if I forget my internet banking username?

If you happen to forget your internet banking username, you have to visit your home branch and request for re-registration.

What are the good practices to create a password?

The good practices to create a password for your internet banking account are:

- Do not choose your name, family name, or vehicle number as your password.

- It is recommended to choose a word that is not available in English dictionary.

- Change your password at regular intervals of time.

- Do not note your password anywhere. Memorise your password.

- Do not share your password with anyone even if they claim that they are from SBI.

Can I change the username and password provided to me by courier?

The username and password sent to you by courier are system-generated and it is mandatory for you to change them on your first login. Later, you can only change the password and not the username.

Related Articles

SBI Mobile Banking

HDFC Bank Netbanking

Canara Bank Netbanking

ICICI Bank Netbanking

Axis Bank Netbanking

How to Add Multiple Account in Sbi Online Banking

Source: https://cleartax.in/s/sbi-netbanking